Unique form identifier. Source Income Subject to Withholding is used to report any payments made to foreign persons.

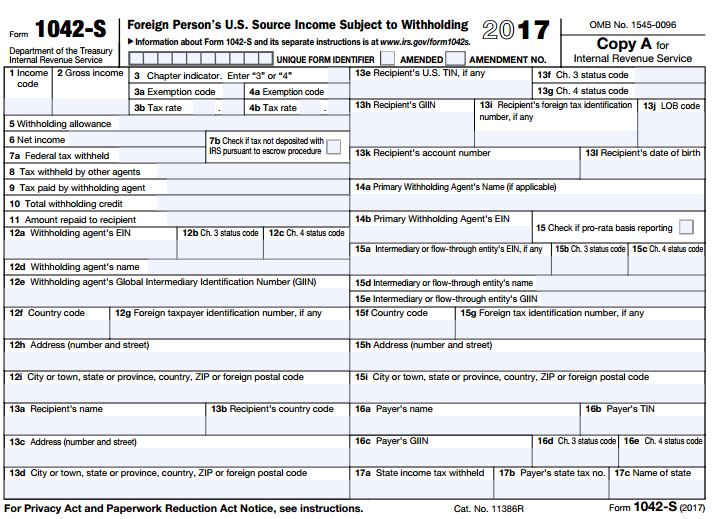

1042 S 2017 Public Documents 1099 Pro Wiki

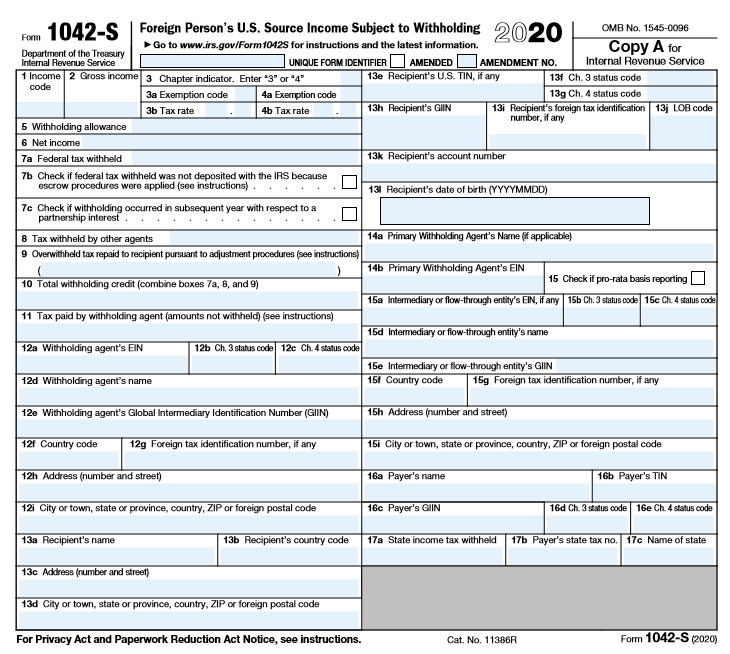

Form 1042-S Foreign Persons US.

Unique form identifier 1042-s. This will be a mandatory requirement starting in 2017. This will be helpful if multiple 1042-S forms are filed for the same recipient and one or more of the forms are amended. Unique to each original Form 1042-S filed for the current year.

1 Income 2 Gross income 3 Chapter indicator. The new field requires withholding agents to assign a unique identifying number to each original Form 1042-S that is filed. For example a new requirement for Form 1042-S beginning in 2017 was that a Form 1042-S had to have a unique form identifier.

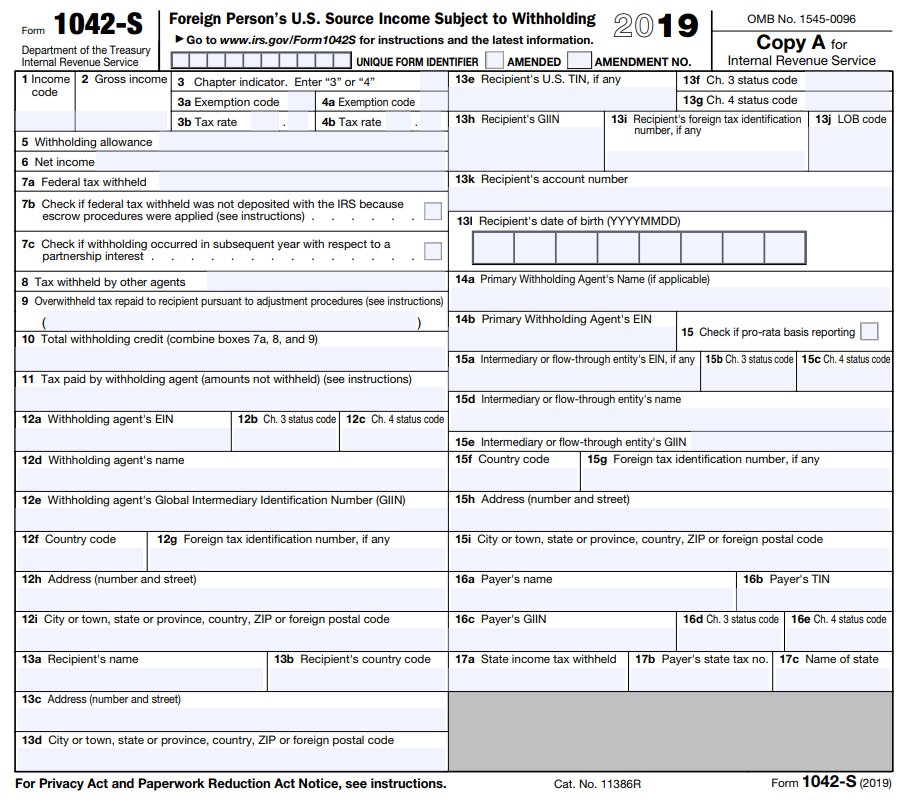

This was implemented to allow the IRS to track amended and corrected forms issued to the same recipient. Each 1042-S form will now need to have a unique form identifier. UNIQUE FORM IDENTIFIER AMENDED.

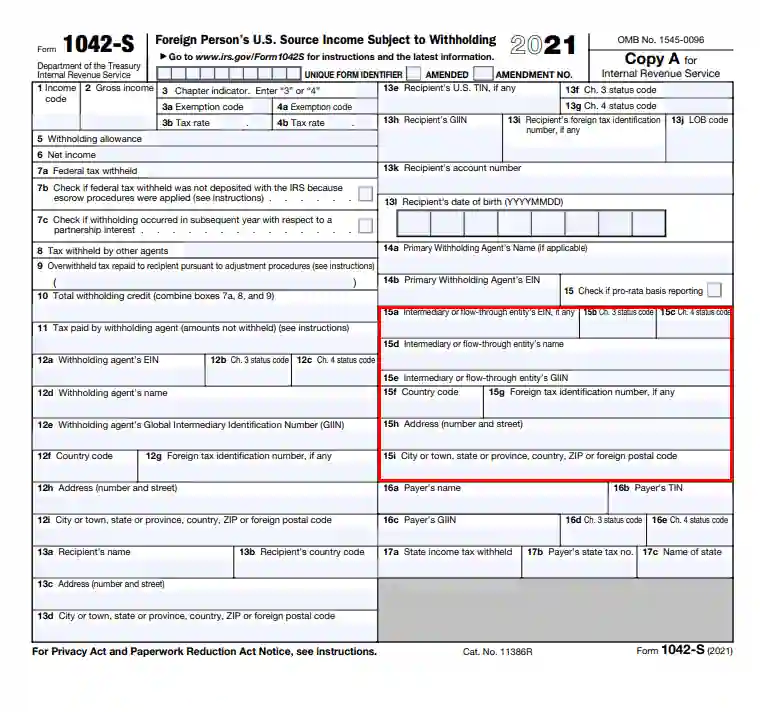

The mandatory UFI must be created by the Retirement System and cannot be the recipients. Finally in the field Unique form identifier must be inserted an unique code of the form to be corrected. 1545-0096 Copy E Department of the Treasury for Withholding Agent Internal Revenue Service UNIQUE FORM IDENTIFIER AMENDED AMENDMENT NO.

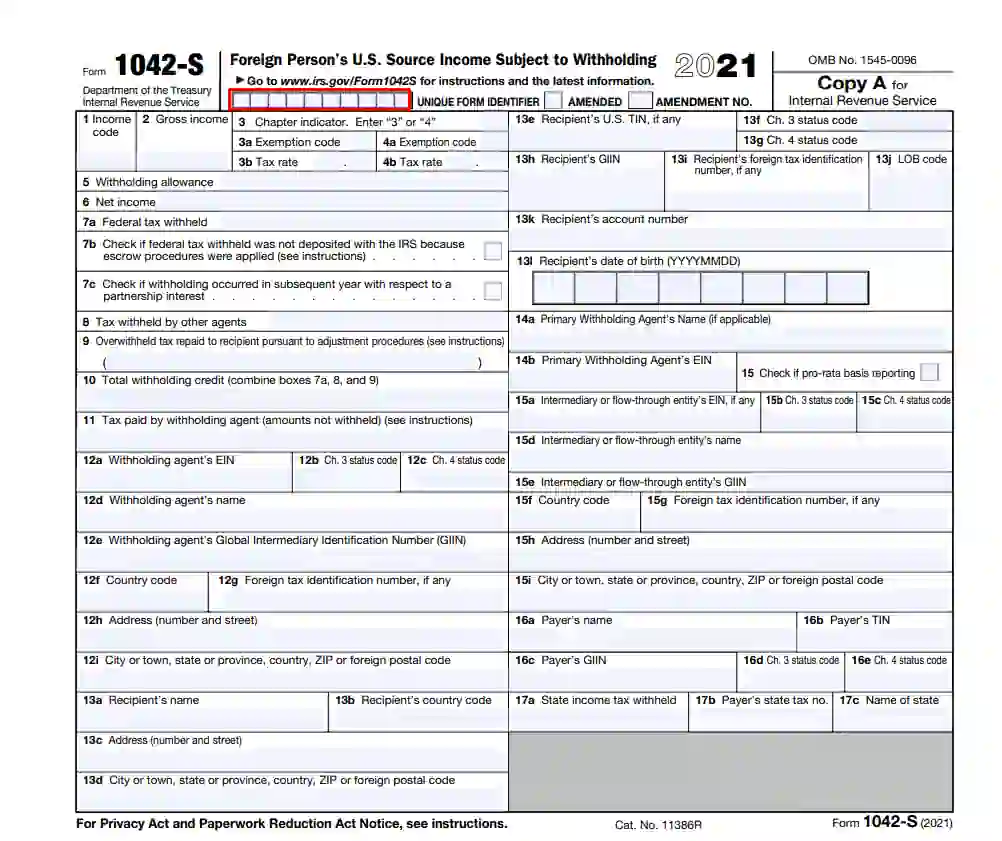

The IRS says the Unique Form Identifier must be. Forms 1042-S and 1042 Annual Withholding Tax Return for US. Be numeric for example 1234567891 Be exactly 10 digits and Not be the recipients US.

The unique form identifier must. Or foreign tax ID number and is a ten digit number chosen by the withholding agent. Source Income Subject to Withholding Go to wwwirsgovForm1042S for instructions and the latest information.

The form is typically completed by a withholding agent who can be represented by a university representative an employer or any other individual to report the annual amount of. Form 1042-S Department of the Treasury Internal Revenue Service Foreign Persons US. A withholding agent must.

The report indicates that processes at the IRS were being updated to make use of the unique form identifier. Withholding agents must assign a unique identifying number to each Form 1042-S they file. UNIQUE FORM IDENTIFIER AMENDED.

Source Income Subject to Withholding. This identifying number is used for example to identify which information return is being corrected or amended when multiple information returns are filed by a withholding agent with respect to the same recipient. Withholding agents must assign a unique identifying number to each Form 1042-S they file.

Specifically the IRS created a new field on the 2017 Form that requires withholding agents to assign a Unique Form Identifier UFI to each original 1042-S Form that is filed. Form 1042-S Department of the Treasury Internal Revenue Service Foreign Persons US. The Unique Form Identifier UFI must be numeric and exactly 10 digits.

For Electronic Filing of Form 1042-S Foreign Persons US. Source Income Subject to Withholding Go to wwwirsgovForm1042S for instructions and the latest information. Source Income Subject to Withholding.

This is different than a US. 2 Gross income 3. A withholding agent must provide a unique form identifier number on each Form 1042-S that it files in the box provided at the top of the form.

The Unique Form Identifier UFI must be numeric and exactly 10 digits. The field Amendment NO must show the version of the form ie. Be numeric for example 1234567891 Be exactly 10 digits and Not be the recipients US.

Form 1042-S Foreign Persons US. Source Income of Foreign Persons are IRS tax forms that deal specifically with payments to nonresident aliens and other foreign persons. The unique form identifier must.

The IRS has created a new field on the 2017 Form 1042-S. This identifying number is used for example to identify which information return is being corrected or amended. Copy C for Recipient Attach to any Federal tax return you file 1 Income code.

How many times that same 1042-s has been subject to correction. The 1042-S must be flagged as Amended to indicate that it is a correction form. One of the forms that help the tax agency to control this type of financial transaction is Form 1042-S.

Unique Form Identifier The IRS has created a new field on the 2017 Form 1042-S that will require withholding agents to assign a unique identifying number to each original Form 1042-S that is filed. Unique Form Identifier Of notable interest is the new requirement that each Form 1042-S have a unique 10 numeric digit identifier. Beginning in tax year 2017 withholding agents will be required to assign a unique form identifier to each Form 1042-S they file.

Unique Form Identifier A withholding agent must provide a unique form identifier number on each Form 1042-S that it files in the box provided at the top of the form.

1042 S 2019 Public Documents 1099 Pro Wiki

Irs Form 1042 S Fill Out Printable Pdf Forms Online

Irs Form 1042 S Fill Out Printable Pdf Forms Online

Irs Form 1042 S Fill Out Printable Pdf Forms Online

1042 S 2018 Public Documents 1099 Pro Wiki

1042 S 2020 Public Documents 1099 Pro Wiki

1042 S 2016 Public Documents 1099 Pro Wiki

The Newly Issued Form 1042 S Foreign Person S U S Source Income Subject To Withholding

0 comments:

Post a Comment