Unique Acknowledgement of the corresponding Form No. After confirming Form 15 CA with Acknowledgment number will be displayed on screen.

How To E File Form 15ca And 15cb

It is to mandatory to upload Form 15CB before filling Part C of Form 15CA.

Unique acknowledgement number form 15ca. It is an 18 digit system-generated number. The Remitter Company has to approve the same5. View Acknowledgement Number Time remaining.

Unique Document Identification Number is a unique number generated on the UDIN Portal for every document certified or attested by the Practicing Chartered Accountants who have registered themselves on the portal. Form 15CA is a declaration made by the person remitting the money wherein the remitter states that the tax has been deducted from any payments so made to the non-resident. Step 6 The details of Acknowledgement Number is displayed as a popup.

How to prepare Form 15CA manually. According to the guidelines of the Income-tax Act 1961 Form 15CA Form 15CB should be filed electronically. Form 15CB is to be filled only when the remittance amount exceeds Rs 5 Lakh during the FY.

Step 3 Select 15CB as Form Name and Click Submit. 30 minutes 00 seconds. Step 5 To view the details of the Form click on the Acknowledgement Number.

Mention Total Payment as entered in Form 26QB to view the details. 15CA if available Country to which remittance is made Email ID of deducte e Contact number of deductee Address of deductee in country of residence Tax Identification Number Unique identification number of deductee 727 728 729 730 731 732 733 734 735 736 737 738 1 2. PROCEDURE OF SUBMITTING FORM 15CA 1.

15CB and 15CA an acknowledgement generates which is provided to the Banker for processing of remittance. 15CA is not mandatory. Finally when the confirmation is done a 15 digit unique acknowledgment number will be displayed.

Form 27Q is the quarterly e-TDS statement furnished for TDS from payments to non. 15CA in the Form 27Q. View is provided for the purpose of retrieving the Acknowledgement Number generated from TIN website issued to TransfereeBuyer.

Better you regularise the transaction by filing Form 15CA and submit with the bank as well if the system online form at income tax website allows to do that. Validation for the field Unique acknowledgement of the corresponding Form no 15CA if available in Annexure I has been modified to permit any alpha-numeric value between 12 to 15 characters in the Form 27Q statement. Instructions to e-File Form 15CA and 15CB 5 Step 4 The status of the Form is changed to Form 15CA Withdrawn.

Download the FVU from TIN website under the option Form 15CA in download section. Step 2 Enter the Membership Number of the CA. 112013 dated 19022013 requiring the person filing Form 15CA to mandatorily quote the Unique Acknowledgement number generated after successful submission of Form 15CA in the Form 27Q which serves as the quarterly e-TDS statement for TDS deducted on payments made to non-resident under section 2003.

Check and confirm the details. 112013 dated 19022013 mandated to quote the Unique Acknowledgement of the corresponding Form No. On download file with name Form15CAFVUexe will be saved at the desired location.

Individual is not required to furnish the information in Form 15CA and 15CB for remittance which requires no RBI approval. 16 July 2015 As per my knowledge quoting unique acknowledgement of the corresponding Form No. CBDT has vide Notification No.

To present the details in Part C of Form 15CA the acknowledgment number of e-Filed Form 15CB should be given. Form 15CA and 15CB for making foreign payments. The applicant must save it in his personal computer and take a print of it.

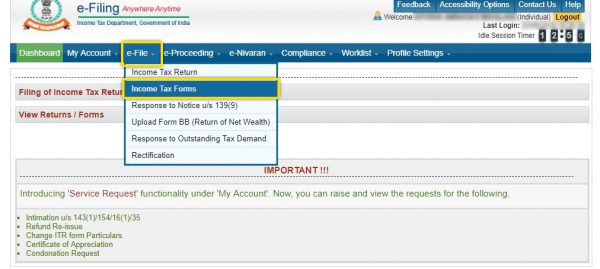

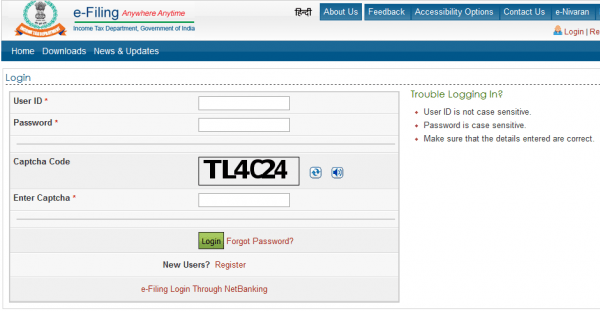

When the CA submits the two forms ie. Step 1 Login to e-Filing Portal Navigate to My Account Add CA. Make a note of these numbers for future reference.

After filing the details a confirmation screen will be displayed. Select the mode as Online and click on Continue Details filled by the deductee will appear in 4 categories. Obtain a 15CB Form from the chartered accountant.

Steps for filing Form 15CA Part C and Form 15CB Online mode Note. Once the taxpayer adds the CA the CA can file Form 15CB in behalf of the Taxpayer. To prefill the details in Part C of form 15CA the Acknowledgement Number of e- verified form 15CB should be verified 15 CA and 15 CB not required in following cases.

For installing the File Validation Utility double click on the file downloaded Form15CAFVUexe from the TIN website. CBDT issued a Notification No. On Successful e-verification Transaction ID and Acknowledgement No will be displayed.

In case of signing and submission of online certificates like Form 15CA or Form 15CB. Besides Form 15CB CA also generate a Unique Document Identification Number UDIN on ICAI web portal as per the ICAI Regulations. Validation for field Form 15CA Unique Acknowledgement Number if available in Annexure I of Form 27Q applicable for FY 2013-14 onwards.

Part A To be filled up if the remittance is chargeable to tax under the provisions of the Income-tax Act1961 and the remittance or the aggregate of such remittances as the case may be. Go to the website and fill all the details of Part A and Part B. Under the income tax act 1961.

PAN Application through NSDL website Ekyc or Signed Document Submission. 15CA See rule 37BB Information to be furnished for payments to a non-resident not being a company or to a foreign company Ack.

How To E File Form 15ca And 15cb

Form 15ca And 15cb Complete Details With Examples

Form 15ca Of Income Tax Information Download Indiafilings

How To E File Form 15ca And 15cb

Form 15ca Of Income Tax Information Download Indiafilings

Form 15ca Of Income Tax Information Download Indiafilings

Form 15ca Of Income Tax Information Download Indiafilings

How To E File Form 15ca And 15cb

How To E File Form 15ca And 15cb

0 comments:

Post a Comment