For Form 15G à 10 alphanumeric characters starting with G following by 9 Digits For example G000000001. 3 The person responsible for paying any income of the nature referred to in sub-section 1 or sub-section 1A or sub-section 1C of section 197A shall allot a unique identification number to each declaration received by him in Form No15G and Form No15H respectively during every quarter of the financial year in accordance with the.

Complete Guide For Persons Who Receives Form 15g Or Form 15h Taxadda

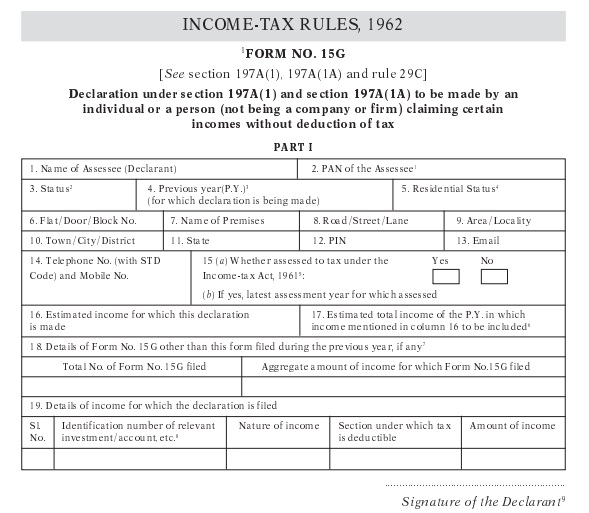

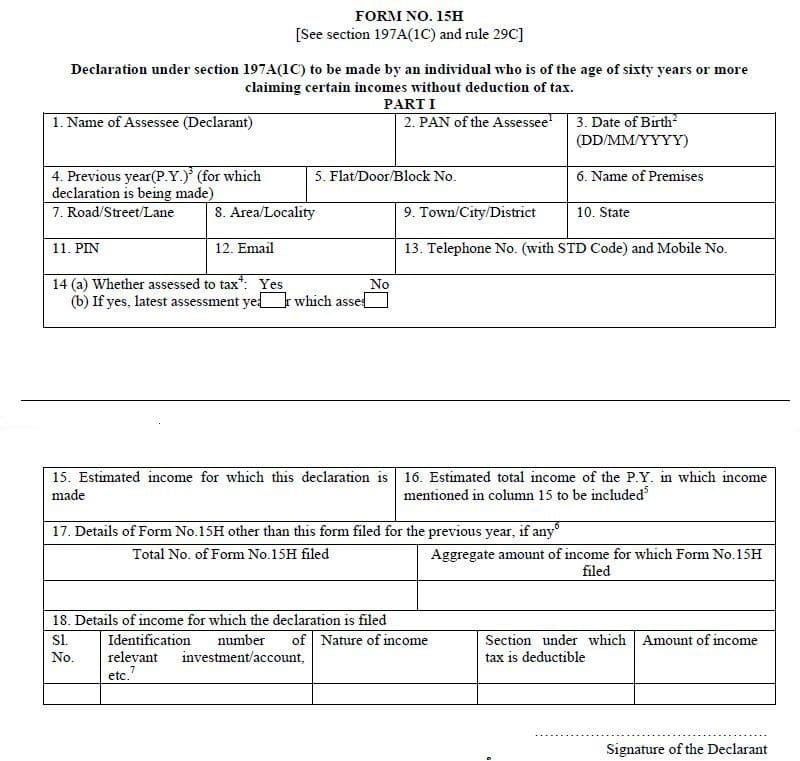

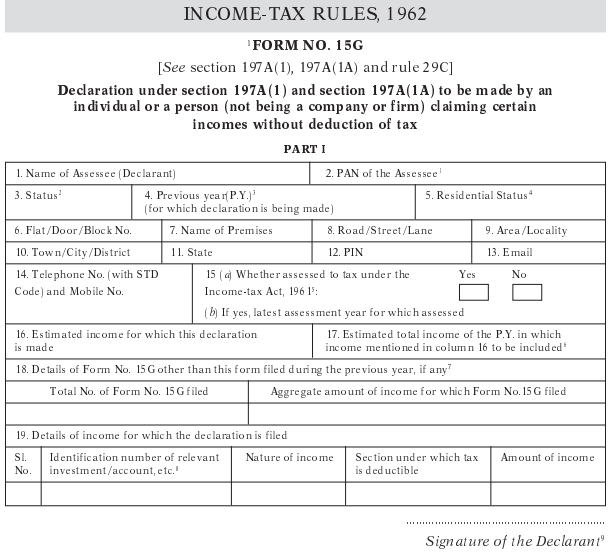

Form No 15G and Form No 15H.

Unique identification number form 15g. 11The person responsible for paying the income referred to in column 16 of Part I shall allot a unique identification number to all the Form No. Form 15G is a document that must be submitted to ensure that TDS is not subtracted on your come provided you are eligible for the same. The person responsible for paying the income referred to in column 16 of Part I shall allot a unique identification number to all the Form No.

UIN for Form 15G Form 15H. B Financial year for which declaration is being furnished. The person responsible for making a payment or the Deductor shall allot a UIN Unique Identification Number to each Form 15G and Form 15H received.

The Form 15G and Form 15H was revised from October 1 2015 and has been simplified. 15G received by him during a quarter of the financial year and report this reference number along with the particulars prescribed in rule 31A4vii of the Income-tax Rules 1962 in the TDS statement. 21 UIN shall consist of following three fields a b and c a Sequence Number 10 alphanumeric for Form 15G15H given as follows.

A unique identification number to all theFormNo15G received by him during a quarter of the financial year and report this reference number alongwith the particulars prescribed in rule 31A4vii of the Income-tax Rules 1962 in the TDS statement furnished for the same quarter. From Q3 2015 onwards FVU 49 onwards it is now mandatory to quote a unique identification number for all Form 15G or 15H declarations. 15G received by him during a quarter of the financial year and report this reference number along with the particulars prescribed in rule 31A4vii of the Income-tax Rules 1962 in.

You would need to file income tax return if you so mandated by law. The UIN will consist of 3 fields A sequence number. 15G received by him during a quarter of the financial year and report this reference number along with the particulars prescribed in rule 31A4vii of the Income-tax Rules 1962 in the TDS statement furnished for.

The deductor will however be required to retain Form No15G and 15H for seven years. 11 The person responsible for paying the income referred to in column 16 of Part I shall allot a unique identification number to all the Form No. The person responsible for paying the income referred to in column 16 of Part I shall allot a unique identification number to all the Form No.

Form 15GH is just to prevent the hassle of TDS and later seeking refund. Click here to read the official press release. Form 15G is to be filled only for Individuals less than 60 years if 60 yrs then fill Form 15H Proprietorship Society Associations of Persons Trust HUF etc 2.

The particulars of self-declarations will have to be furnished by the deductor along with UIN in the quarterly TDS statements. The requirement of submitting physical copy of Form 15G and 15H by the deductor to the income-tax authorities has been dispensed with. The Deductor shall mention the particulars of these Form 15G Form 15H received during any quarter of the financial year along with the unique identification number allotted by him in TDS Quarterly Statements whether or not any TDS.

It would create more problems than solve. TDS waiver will not be marked if PAN details are not updated on the Banks record 3. Deductor needs to furnish the details of all the self-declaration along with unique identification number UIN to Income Tax Department via quarterly TDS statement.

The deductor is responsible for assigning a unique identification number UIN for each declaration they receive. One should keep in mind that self-declaration using Form 15G holds good only for that particular financial year. 15G received by him during a quarter of the financial year and report this reference number along with the particulars prescribed in rule 31A4vii of the Income-tax Rules 1962 in the TDS statement.

According to the CBDT or Central Board of Direct Taxes the deductor must assign Unique Identification Number or UIN for every declaration signed by taxpayers. KEY CHANGES-Form No 15G and Form No 15H can be e filed-Payee to Specify no of Form No 15G and Form No 15H filed during the year PayerDeductor will allot unique identification number to each declaration received by him in Form No 15G and Form. Allotment of UIN Unique Identification Number.

15G received by him during a quarter of the financial year and report this reference number along with the particulars prescribed in rule 31A4vii of the Income-tax Rules 1962 in the TDS statement. Do not submit Form 15GH if you are not eligible to do so. 11The person responsible for paying the income referred to in column 16 of Part I shall allot a unique identification number to all the Form No.

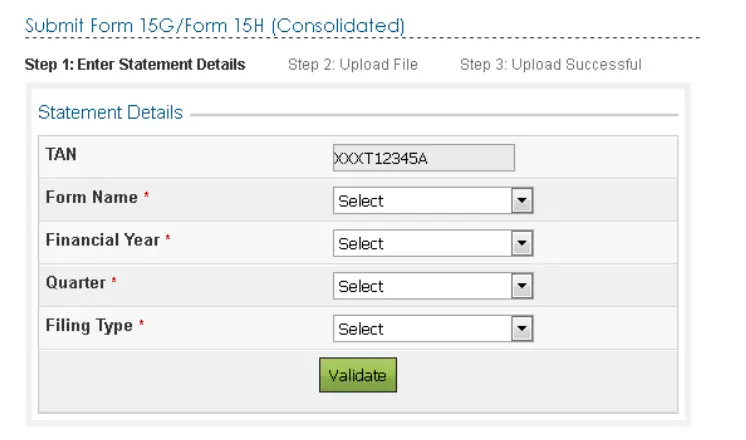

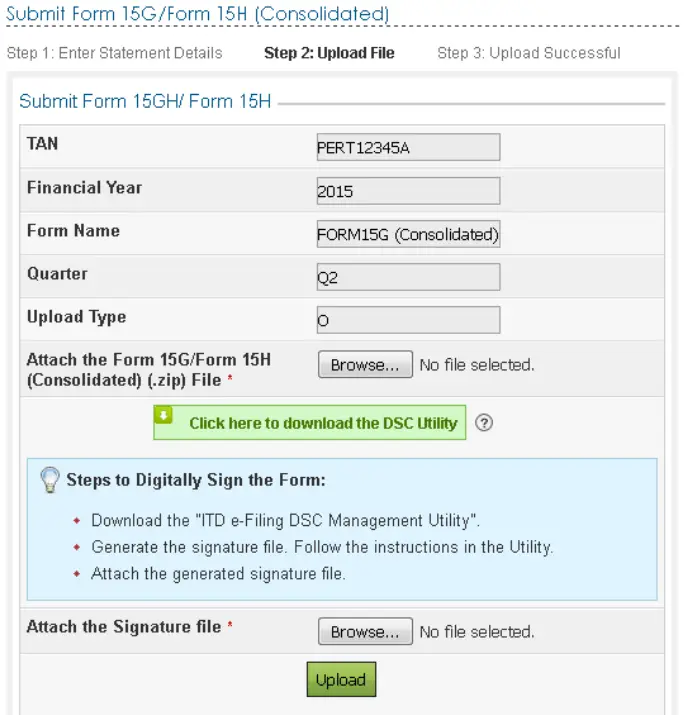

The taxpayers are required to fill up Form 15G online by visiting the official IT departments website. Also the reporting to income tax department has. Form 15G is valid for one financial year and eligible individuals must submit them every year.

This is a 10 digit alphanumeric sequence which starts with G if it is allotted for Form 15G or H if it is for Form 15H. UIN contains three fields Sequence number of 10 digits as given below For form 15G G followed by 9 digits G000000001 G000000002 and so on For form 15H H followed by 9 digits H000000001 H000000002 and so on. 09 March 2016 Allotment of UIN Unique Identification Number UIN to be alloted by Payers UIN shall consist of 3 fields 1 Sequence Number 10 alphanumeric for Form 15GForm15H.

Form 15g Download How To Fill 15 G Form Online

How To Fill Form 15g How To Fill Form 15h

How To Fill New Form 15g Or New Form No 15h

How To Fill Form 15g How To Fill Form 15h

Complete Guide For Persons Who Receives Form 15g Or Form 15h Taxadda

How To Fill Form 15g How To Fill Form 15h

How To Guide To Fill New Form 15g And 15h Tds Waiver

Form 15g How To Download Form 15g Online Paisabazaar Com

0 comments:

Post a Comment